U.S. Bancorp Investments accounts: Yes.Tax documents are available for up to four years. Trust, agency, custody, or IRA accounts with Ascent Private Capital Management, U.S. Bank Private Wealth Management or U.S. Bank Wealth Management: Online statements and performance reports are available in online and mobile banking for up to seven years.When you sign up for e-statements, you’ll automatically be able to view e-statements, with availability building over time to seven years of available e-statements. Consumer and business credit card, charge card, credit line, personal line of credit and investment equity line of credit accounts: Yes.Up to seven years of statements are available for online viewing Business loan and line of credit accounts: You automatically receive e-statements.When you sign up for e-statements, up to seven years of e-statements are immediately available for online and mobile viewing. Consumer loan and home equity line of credit accounts: Yes.

When you sign up for e-statements, up to two years of e-statements are immediately available for online and mobile viewing. 13, 2017, you will continue to see previous e-statements from that time. If you signed up for paperless prior to Aug. If you chose to go paperless after August 2017, you will see your e-statements beginning Aug.

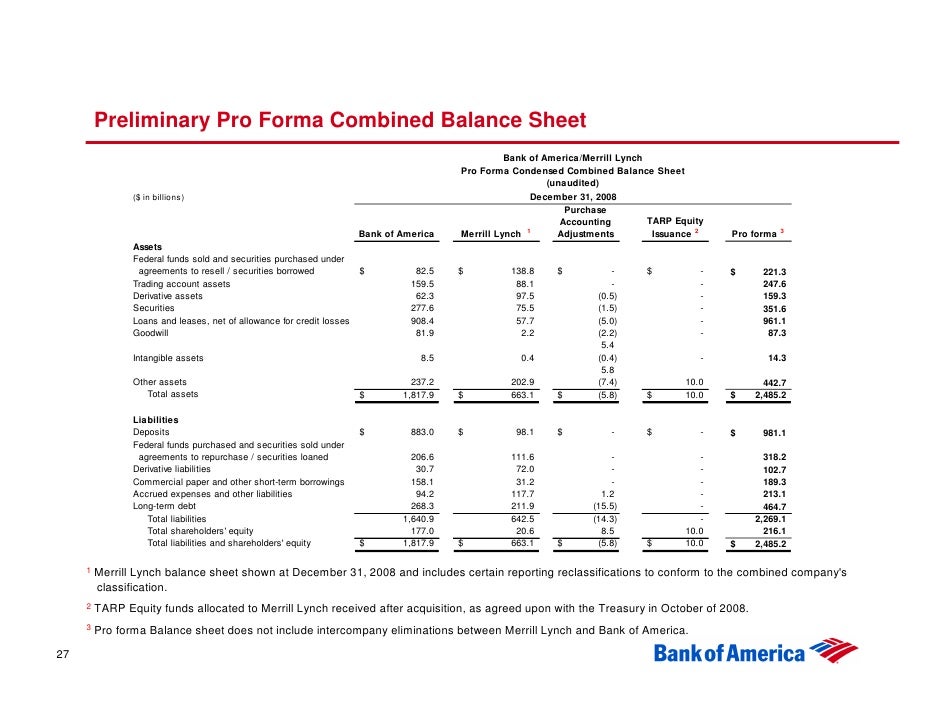

If you choose e-statements, you will no longer receive paper statements. Consumer loan and home equity line of credit accounts: You automatically receive paper statements.If you choose e-statement only, you will no longer receive paper statements or paper versions of most letters and notices. Checking, savings and money market accounts: You automatically receive paper and e-statements.(MLLA) and/or Banc of America Insurance Services, Inc., both of which are licensed insurance agencies and. Total assets can be defined as the sum of all assets on a companys balance sheet. Insurance Products are offered through Merrill Lynch Life Agency Inc. Bank Of America total assets from 2010 to 2023.

Both are indirect subsidiaries of Bank of America Corporation.

#CHECKBOOK BALANCE SHEET FOR BANK OF AMERICA OFFLINE#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful.

0 kommentar(er)

0 kommentar(er)